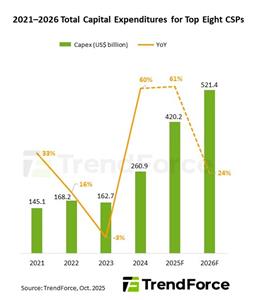

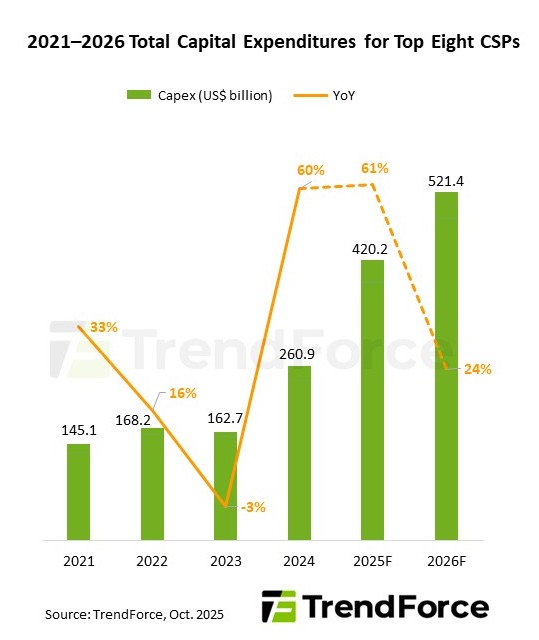

CSP CapEx to Soar Past US$520 Billion in 2026, Driven by GPU Procurement and ASIC Development, Says TrendForce

TAIPEI, Taiwan, Oct. 13, 2025 (GLOBE NEWSWIRE) -- TrendForce’s latest investigations reveal that the rapid expansion of AI server demand is propelling global cloud service providers (CSPs), such as Google, AWS, Meta, Microsoft, Oracle, Tencent, Alibaba, and Baidu, to boost investments in NVIDIA’s rack-scale GPU solutions, data center expansion, and in-house AI ASIC design. Total CapEx from the eight major CSPs is expected to surpass US$420 billion in 2025, roughly equivalent to their combined spending in 2023 and 2024, marking a 61% YoY increase.

TrendForce predicts that as rack-scale solutions like GB/VR systems grow in 2026, the total CapEx of the eight CSPs will hit a new peak, surpassing US$520 billion with a 24% year-over-year rise. Additionally, investment priorities are moving from revenue-generating assets to short-lived infrastructure such as servers and GPUs, indicating a strategic emphasis on boosting long-term competitiveness and market share rather than immediate profits.

In 2025, NVIDIA’s GB200/GB300 rack systems are poised to become the main deployment targets for CSPs, driven by higher-than-anticipated demand growth. Besides North America’s leading four CSPs and Oracle, emerging customers such as Tesla/xAI, CoreWeave, and Nebius are increasing their purchases for AI cloud leasing and generative AI workloads. By 2026, CSPs are likely to shift from GB300 racks to the new NVIDIA Rubin VR200 rack platform in the latter half of the year.

Custom AI chip production continues to scale up

North America’s leading four CSPs are increasing their investments in AI ASICs to improve autonomy and manage costs for large-scale AI and LLM tasks. Google is partnering with Broadcom on the TPU v7p (Ironwood), an optimized platform for training, set to expand in 2026 and succeed the TPU v6e (Trilium). TrendForce predicts Google’s TPU shipments will stay the highest among CSPs, with over 40% annual growth in 2026.

AWS is prioritizing its Trainium v2 chips, with a liquid-cooled rack version expected by late 2025. The Trainium v3, developed jointly with Alchip and Marvell, is planned for mass production in early 2026. AWS’s ASIC shipments are anticipated to more than double in 2025, marking the fastest growth among major CSPs, with a further approximate 20% increase in 2026.

Meta is enhancing its partnership with Broadcom, with MTIA v2 set for mass production in Q4 2025 to boost inference efficiency and lower latency. In 2025, shipments will mainly back Meta’s internal AI platforms and recommendation systems, while MTIA v3, which includes HBM integration, will launch in 2026, doubling total shipment volume.

Microsoft intends to mass-produce Maia v2 with GUC in the first half of 2026. However, the schedule for Maia v3 has been postponed because of design changes, resulting in limited ASIC shipments in the near term and falling behind competitors.

For more information on reports and market data from TrendForce’s Department of Semiconductor Research, please click here, or email the Sales Department at SR_MI@trendforce.com

For additional insights from TrendForce analysts on the latest tech industry news, trends, and forecasts, please visit https://www.trendforce.com/news/

About TrendForce

TrendForce is a global provider of the latest development, insight, and analysis of the technology industry. Having served businesses for over a decade, the company has built up a strong membership base of 500,000 subscribers. TrendForce has established a reputation as an organization that offers insightful and accurate analysis of the technology industry through five major research divisions: Semiconductor Research, Display Research, Optoelectronics Research, Green Energy Research, and ICT Applications Research. Founded in Taipei, Taiwan in 2000, TrendForce has extended its presence in China since 2004 with offices in Shenzhen and Beijing.

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.